Systemic Risk In Decentralised Finance: What To Know

Decentralized Financial Systemic Risk: Understanding Threats and Reduction Measures

The growth of decentralized finance (defi) has changed how people manage their finances, but it also poses a big risk. One of the most urgent concerns is a systematic risk that may have distant effects if they are not marked.

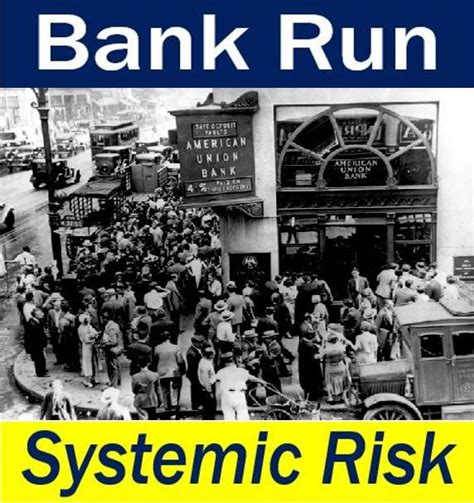

What is a systemic risk?

Systemic risk means the potential of the financial system collapse caused by a combination of factors such as market failures, regulatory shortcomings, or complex interaction between different system components. Depending on the defi, the systemic risk is due to the value of specific assets, such as cryptocurrencies and lack of maintenance and adjustment.

Decentralized financial risk

Single

2.

3

Regulatory uncertainty : Changes in regulatory policy or lack of clear guidelines can lead to uncertainty and instability in defi markets.

- Market Manipulation

: Complex characters can try to manipulate price changes by spreading false information or creating artificial market conditions.

Cryptocurrency role

Cryptocurrencies, such as Bitcoin and Ethereum, have become the main point for many defi programs due to their decentralized and lack of government control. However, it also increases the risk of systemic instability:

Single

2.

Smoking Measures

It is very important to follow a layered approach to reduce the risk of system system:

Single

2.

3

Liquidity Management : Introduce effective liquidity management strategies such as layering, risk limiting and market production to reduce liquidity crisis.

- Stress Test : Perform DEMBI platform tests for stress tests regularly to determine vulnerability and mitigation strategies.

Conclusion

Systemic risk raises key concerns about decentralized finances, especially when it comes to cryptocurrency. By understanding the risk and emollient measures, investors can reduce the impact of potential instability and ensure that it is actively protected.

The Defi ecosystem continues to grow and develop, and it is very important for government institutions and market players to work together to develop clear guidelines and rules that apply systemic risk. Only with a layered approach to managing this risk can we create a more durable and sustainable defi environment.

suggestions

Single

2.

3.