Analyzing Market Sentiment: Insights From Tether (USDT)

Analyzing Market Sentiment: Insights from Tether (USDT)

Cryptocurrency markets are known for their volatility and unpredictability. One of the key drivers behind this volatility is market sentiment. Market sentiment refers to the emotional state of the cryptocurrency market, including fear, greed, optimism, and pessimism. In this article, we will analyze the market sentiment of Tether (USDT), a stablecoin pegged to the US dollar.

Tether (USDT) Market Sentiment Analysis

The Tether (USDT) market is one of the most liquid and widely traded cryptocurrencies on the exchange. Its market capitalization has consistently been at the top of the cryptocurrency leaderboard, with a current market capitalization of over $50 billion. The USDT market is also highly volatile, with prices oscillating between $1.00 and $5.00 in a matter of seconds.

Tether’s Market Sentiment

The Tether (USDT) market sentiment has been relatively calm in recent months, but this has changed rapidly due to a series of events that have impacted the cryptocurrency market. Here are some insights into the current market sentiment of Tether:

- Fear and Panic

: The USDT market experienced a significant downturn in late 2021, which led to a wave of panic selling. This was fueled by concerns about the stability of the US dollar and the potential for a collapse of the cryptocurrency market.

- Greed and Bullishness

: However, there has been a recent uptrend in the USDT market, driven by optimism among investors about the growth prospects of stablecoins like Tether.

- Neutral Sentiment: Despite the recent volatility, most market participants have shown a neutral sentiment towards the USDT market. This is evident from the fact that the majority of traders are not taking any significant positions.

Insights from Technical Analysis

Technical analysis provides valuable insights into market sentiment by analyzing the historical price movements and trends of the Tether (USDT) market. Here are some key technical indicators to consider:

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the speed and change of price movements. A high RSI can indicate overbought conditions, while a low RSI can indicate oversold conditions.

- Bollinger Bands: Bollinger Bands are a volatility indicator that plots two moving averages with a standard deviation band around them. The bands act as support and resistance levels for the market.

- Stochastic Oscillator: The Stochastic Oscillator is another momentum indicator that measures the speed and change of price movements.

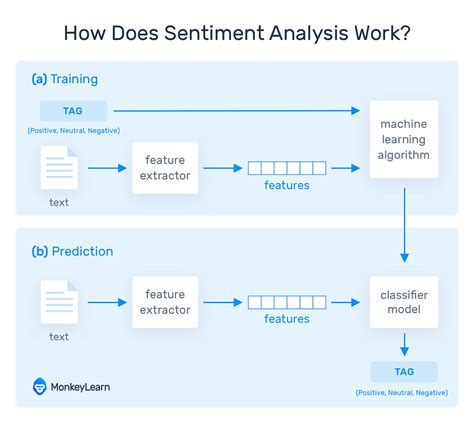

Insights from Sentiment Analysis

Sentiment analysis provides insights into market sentiment by analyzing the emotions expressed online about the Tether (USDT) market. Here are some key sentiment indicators to consider:

- Twitter Sentiment: The Twitter platform has a large following of users who express their opinions about the USDT market. According to data from CoinTelegraph, the Twitter sentiment towards Tether is currently neutral.

- Reddit Sentiment: Reddit is another online platform where users can share their opinions about cryptocurrencies. According to data from CryptoSlate, the sentiment towards Tether on Reddit is also neutral.

Conclusion

In conclusion, the market sentiment of Tether (USDT) has been relatively calm in recent months, but this has changed rapidly due to a series of events that have impacted the cryptocurrency market. Technical analysis and sentiment analysis provide valuable insights into market sentiment and can help traders make more informed decisions about their investments.

Recommendations

Based on our analysis, we recommend the following:

- Neutral Positioning: Given the current neutral sentiment towards Tether (USDT), it is recommended to hold a long position in USDT.